A Guide to Winning Intercompany Operations

Table of Contents

- Why Intercompany Has So Many Obstacles

- Why Intercompany Processes Are Becoming More Challenging for Multinational Organizations

- Examples of Intercompany Complexities

- Indications of Intercompany Ineffectiveness

- A Different Way to Manage Intercompany Processes to Support CFO Goals

- How to Win the Intercompany Race

- Cross the Finish Line as a Winner with BlackLine Intercompany Solutions

- End-to-End Transaction Automation

- Key Outcomes of Intercompany Operations Excellence

- It’s Time to Go the Distance with Intercompany

Why Intercompany Has So Many Obstacles

Many organizations overlook intercompany operations as a source of strategic value.

They view intercompany accounting as buying from and selling to themselves, and when it comes to tallying the bookkeeping to produce a set of financial statements, all those intercompany transactions are supposed to cancel each other out.

But because each side of the transaction is recorded separately, it's also common for there to be errors, discrepancies in volume and price, currency, translation, and differences, and other adjustments that must be identified and then corrected. This creates a debit and credit reconciliation hurdle for accounting teams to overcome.

This process is challenging in itself, but what is not well recognized is the complete intercompany picture. Intercompany falls into the wide gap between the need to achieve strategic high-level corporate objectives and handling the intricate details involved in effective process execution.

As many global organizations consist of hundreds, or even thousands, of legal entities, there are tax and regulatory considerations in executing intercompany transactions, especially for those pursuing growth by acquisition. These considerations can be complicated if a transaction involves multiple legal entities buying and selling, especially if the transaction spans multiple countries, each with its own currency, tax regime, and legal jurisdiction.

CFOs and heads of finance, as parties responsible for the big picture, must appreciate that misaligned and imprecise intercompany processes put their organization’s reputation at risk and negatively impact their bottom line.

Too many multinationals have skills and knowledge siloed deep within organizational structures, stunting growth and creating hidden, cascading sets of risk. Instead, they should share information among departments to grow more efficiently and minimize risk. Managing intercompany processes is a systemic issue that involves teamwork and holistic action, yet too many companies are not adapting.

The old way of managing intercompany processes is now unsustainable. Here are three reasons why:

1. Many multinationals report that their intercompany volume is up to 10x greater than revenue.

2. A lack of integration among systems (e.g., ERPs) is resulting in a loss of supporting information.

3. M&A activity is supporting rapid expansion into new industries and geographies.

Although intercompany represents a large portion of multinational commerce, intercompany processes and automation grossly lag external transaction management. All tax jurisdictions want their fair share of revenue from intercompany transactions and now expect related-party transactions to be governed with the same rigor as external transactions. As intercompany transactions increasingly shift profits across borders, operational, regulatory, and tax complexity increases along with associated risks.

For example, consider the negative headlines generated as recognized multinational brands are accused of mismanaging intercompany royalty rates and intellectual property amortization for tax advantage. How multinationals handle these charges between corporate entities has been the target of increased regulatory and public scrutiny.

Although each business unit of a corporation aims to optimize its own results, team members throughout multinationals must think globally, flagging decisions that could create reputational risk or result in higher total tax payments at the corporate level.

Another ironic aspect of intercompany is that, as a rule, those at the top of the organization who stand to benefit the most from improved intercompany operations are unaware that the corporation is failing to execute as it should.

Examples of Intercompany Complexities

Multinational corporations face many intercompany complexities, including:

Driven by the continued rise of globalization, highly complex supply chains are causing intercompany volumes to soar.

Cash is king. Each group business unit naturally aims to optimize its own results—yet those results can drive suboptimal corporate performance. Measures need to be taken to minimize local tax expenses and optimize cash flows through integrated transfer pricing, strategic country-level settlements, and tax strategies.

While CFOs demand more automation, technical tools that still rely on spreadsheets or user interfaces create IT overhead.

A mix of ERP and non-ERP data sources makes up the finance technology landscape, increasing manual effort to mine data and verify that intercompany transactions reconcile and settle across the network.

Intercompany discrepancies are cumulative. These unexplained amounts can seriously impact the accuracy of financials. Manually resolving open items can delay close cycles or increase the risk of non-compliance (e.g., tax and audits) and financial write-offs.

Implementing new regulatory provisions and tax laws in foreign countries can negatively impact financial operations. The rapid adoption of e-invoicing initiatives is just one example of this.

Indications of Intercompany Ineffectiveness

If you are unsure how much impact intercompany has on your organization, consider which of the following red flags you recognize. These problems will keep intercompany from balancing and

cost your organization time and money.

Paying Unanticipated Taxes in Jurisdictions

The effective tax rate in certain jurisdictions seems higher than usual or what was projected

You face cumbersome tax audits relating to non-deductible expenses

You are unable to reclaim VAT/GST

Overdue and Unsettled Intercompany Balances

Unsettled balances keep growing period over period

You don’t have clear visibility into who owes whom

You cannot fully offset intercompany balances as part of your closing process

Never-Ending Charge Disputes and Finger Pointing

Departments are actively clashing or misaligned on recharges and unresolved disputes are escalating to senior-level executives

Controllers complain that intercompany recharges initiated by Tax delay the closing process

FP&A cannot make year-over-year comparisons because of widespread transfer price changes

Accounting is wasting weeks or even months waiting on replies to inquiries about intercompany charges

Unresolved disputes are escalating to senior-level executives

You are unable to track the cost of individual disputes

Continuous Statutory and Tax Audits

Intercompany issues are highlighted in audit letters

Auditors continuously challenge statutory tax documentation

Intercompany is a regular or leading cause of your government’s tax audits (WARNING: Once a penalty is assessed, the company will typically be subjected to several years of audits in most countries.)

Increased Staffing Demands for Accounting

Accounting requests budget for additional FTEs as intercompany transaction volume grows

Shared services centers multiply but fail to deliver on productivity goals

Manual processes are restricting your ability to improve operational productivity burnout

A Slow Close Process

Monthly or quarterly close are delayed as accounting resolves outstanding intercompany charges and balances

Transactions that were not fully resolved in preceding periods must be addressed before the year-end close

Teams suffer through late-night sessions and weekends to close outstanding intercompany issues

A Different Way to Manage Intercompany Processes to Support CFO Goals

Finance and accounting leaders are expected to play a broader role in supporting strategic objectives across the business, including enterprise-wide digital transformation initiatives. Yet, in many cases, the transformation of intercompany processes lags the rest of the business.

Multinational corporations must rethink their global business operations that support the CFO’s goals—creating capacity by eliminating number-crunching gymnastics and improving supply-chain resilience, liquidity, and business profitability.

Defining Intercompany Financial Management

According to ISG, Intercompany Financial Management (IFM) is “a discipline for structuring and handling transactions within a corporation and between its legal entities for maximizing staff efficiency and accounting accuracy while optimizing tax exposure and cash flow, minimizing tax leakage, and ensuring consistent tax and regulatory compliance.” Ultimately, it’s a way for companies to reap the benefits of sound intercompany.

While accounting is an obvious beneficiary, tax, FP&A, and treasury workloads can be optimized to propel a new wave of efficiency and performance:

Tax teams can stay well-informed of increasingly complex tax and regulatory environments on the horizon while increasing indirect tax deductibility, minimizing tax leakage, and hardening tax compliance and defensibility.

Treasury teams no longer have to grapple with intercompany accounting errors—gaining a real-time view of transactions to improve intercompany financing and forecasting and minimize FX exposure with increased netting and settlement efficiency.

FP&A teams have billing and financial transparency to fuel business units with data-driven decisions, which translates to a healthier bottom line.

How to Win the Intercompany Race

“Companies are still thinking about intercompany as a step-by-step process instead of end-to-end.”

Stay Ahead of the Competition by Designing a Holistic Process

When designing intercompany processes, use an integrated intercompany framework divided into seven components that represent the relevant accounting, treasury, tax, legal, and business considerations associated with intercompany transactions.

Governance & Policies

Data Management

Transaction & Tax Management

Netting & Settlement

Transfer Pricing & Invoice Management

Reconciliation & Elimination

Internal & External reporting

Intercompany process thinking and continuous improvement are business-critical concepts that boil down to the following leading practices to help you speed toward operations excellence.

Define Your Target Intercompany Data Model

Many organizations struggle with fragmented, inconsistent intercompany data that requires heavy manual intervention to piece together. Without a unified data model, this decentralized approach leads to delays, reconciliation issues, and misinformed business decisions, especially during times of change like acquisitions.

A global transaction subledger is purpose-built to solve these problems. It establishes a single source of truth for intercompany activity, enabling organizations to standardize data definitions, automate aggregation and reconciliations across all entities and ERPs. By centralizing intercompany data, a global subledger supports better decision-making, cost and margin analysis, and regulatory compliance.

Traditional ERP functionality was never designed for the complexity of today’s multinational environments, where multiple instances and incompatible systems are the norm. A global subledger bridges those gaps, eliminating data conflicts tied to unit pricing, markups, transfer pricing, and even basic transactional metrics like goods delivered.

Establish Intercompany Process Standardization

Different business units or regions may apply different standards to approve and record transactions

(if at all), manage exceptions, invoice according to local regulations, and settle for payment. Standard processes across accounting, finance, tax, and treasury teams are essential in helping you organize and execute intercompany transactions in a repeatable and compliant way.

Optimize and Automate Intercompany Processes

Aim to streamline intercompany to maximize business potential by reducing or eliminating unnecessary activities, rework, wasted effort, and bottlenecks. By standardizing and optimizing intercompany processes, you’re set to automate aspects of the process that otherwise require human effort. For intercompany, the transaction type drives the rules and activities necessary for each step, reducing manual effort or the need for rework later and redistributing that effort to more strategic work.

Once you’ve mapped out your holistic intercompany process and identified areas to optimize and opportunities for efficiency, the next step in your roadmap is execution. In this stage, it will be important to understand how technology can help manage your company’s operations and transaction lifecycles so you can move away from reactive accounting and achieve intercompany excellence. While there are options for handling intercompany, a dedicated intercompany solution is the only way to holistically address the end-to-end process. And that’s where BlackLine can help your organization win the intercompany race.

Cross the Finish Line as a Winner with BlackLine Intercompany Solutions

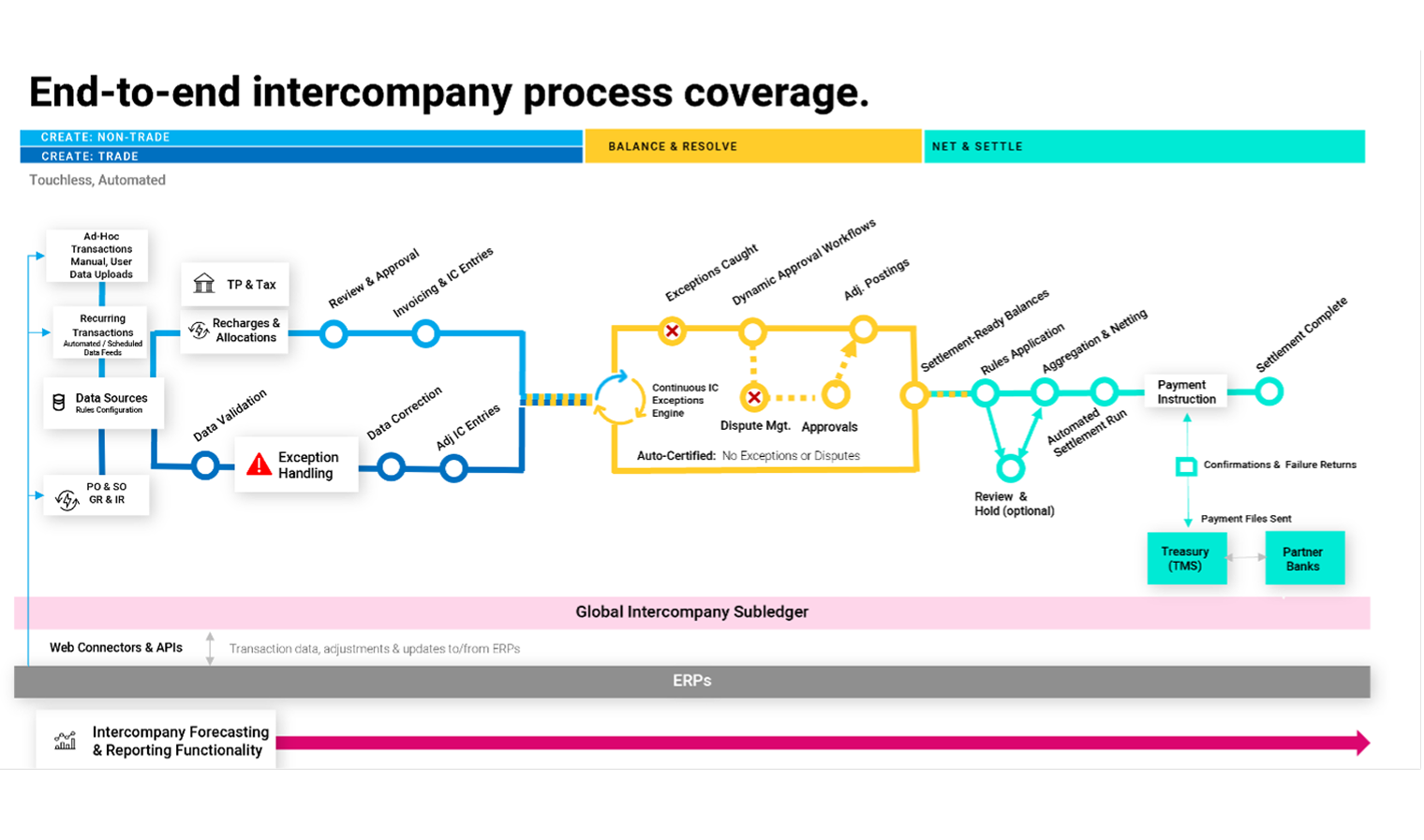

BlackLine Intercompany Solutions—Create, Balance & Resolve, and Net & Settle—comprises a set of technology that uniquely connect all parts of the intercompany landscape. With these solutions, companies can automate and control the complete intercompany lifecycle, from transaction creation through automated balancing, netting, and settlement.

These solutions help multiple teams manage end-to-end intercompany operations within and across legal entities and jurisdictions, including policy, accounting, tax, treasury, intercompany decision-making, charging, documentation, and invoicing.

Operating across one or more ERPs and related systems, you get the correct accounting with proper transfer pricing and taxes applied, as well as automated balancing, netting, settlement, and statutory reporting.

All parties in an intercompany transaction will apply the correct accounting treatment to the transaction and other details, down to the harmonized system codes for cross-border trade, because these details can affect tax expense and regulatory compliance.

End-to-End Transaction Automation

Key Outcomes of Intercompany Operations Excellence

Outcomes

Done well, intercompany can benefit a broad set of people and roles in a corporation through staff and process efficiency gains, better management of tax costs, and greater control of risks.

In multinational organizations where people, products, and services routinely cross legal entities and borders, HR, sourcing, and supply chain managers can better understand total costs and how best to manage them.

And for corporations that use acquisitions strategically, intercompany can streamline the post-merger financial integration process.

“By 2027, one-fifth of organizations with 10,000 or more employees will have implemented IFM to achieve tax, risk management, and financial close benefits.”

Improve Operational Efficiency

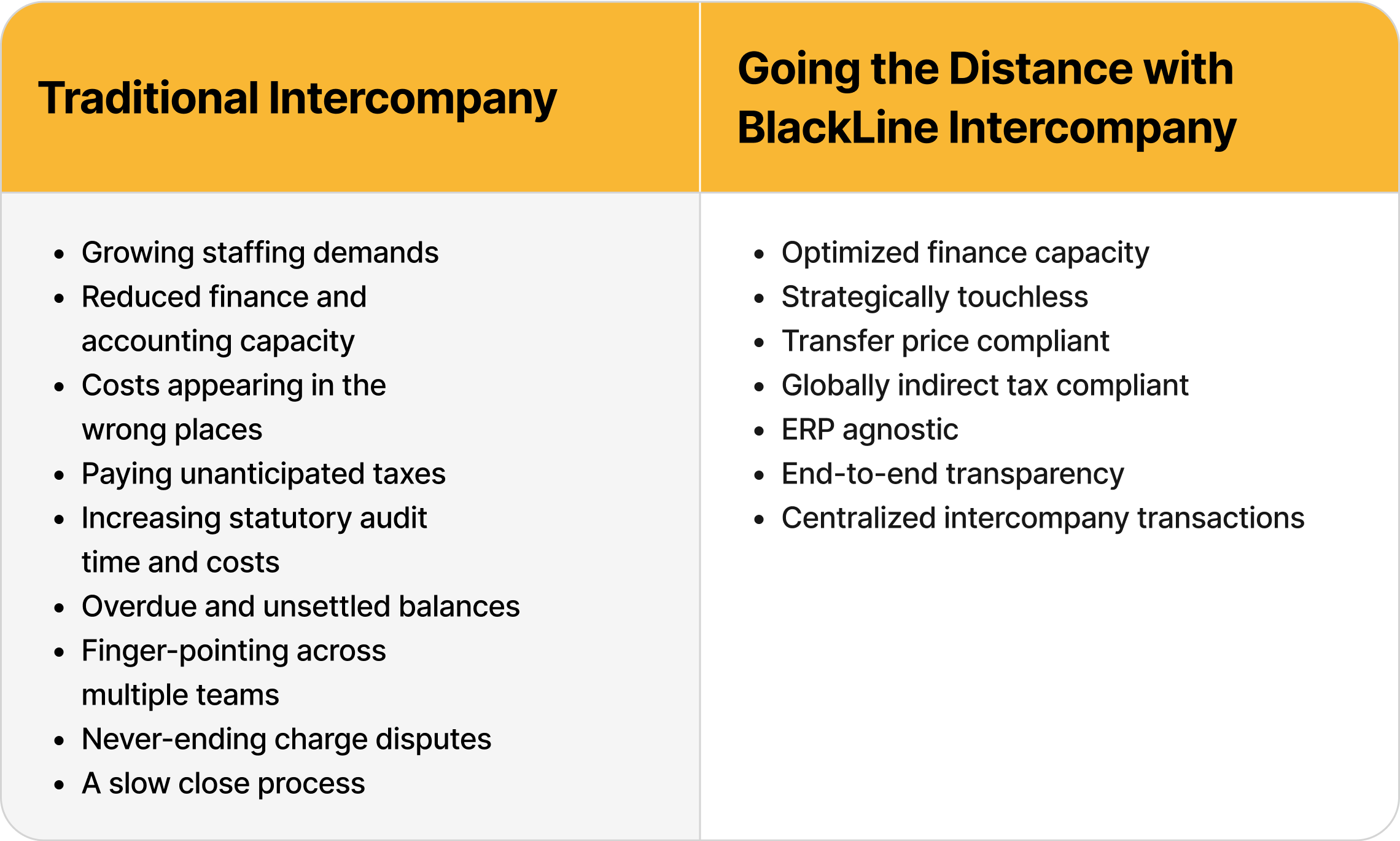

Significant operational inefficiencies often come down to manual, bespoke, unsystematic intercompany processes. BlackLine systematizes, automates, and enforces processes that can unlock value by making intercompany operations more efficient.

Customers see, on average, 60% to 80% efficiency gains, and for closing teams, over a 60% reduction in days to close. These vastly shortened cycle times are particularly important given that long cycle times result in stale data, which is ultimately impaired data. Shortened close cycle times mean more agility, which results in better competitiveness in a global economic environment that is in flux and rapidly changing.

Inform Global Tax Processes

Control, granularity, and accessibility of data related to intercompany generally fall far behind the rigor provided to third-party transactions. Exacerbating the problem are intercompany transactions and the challenges of managing them, which are ever-increasing as companies expand globally and introduce complexity with new, disparate systems, and significantly accelerating the growth of intercompany transaction volumes.

A global subledger with granular transaction data overcomes these challenges. Tax-efficient intercompany processes and pricing strategies enable increased deductibility, reduce tax leakage, and lower effective tax rates so that post-tax income is maximized.

Drive Margin Improvements

Processes and technology are the key drivers of margin improvements because they drive higher productivity and better efficiency. Investing in technology can bring some quick-win improvements (such as more accurate transfer pricing) while proving out ROI over time and establishing automation that continues to deliver dividends over time.

A technology-driven approach to managing intercompany operations helps businesses realize productivity and efficiency gains and creates pathways for new opportunities for growth, best-in-class performance, and continuous margin improvements.

Enhance Cash Precision

Multinational corporations excel at turning trade-based receivables into cash. But significant resources are dedicated to negotiating contracts, delivery, billing, and collections on customer trade to maximize income, cost, and time to revenue.

Enabling a standardized process for intercompany settlements and integration with treasury systems allows businesses to facilitate intercompany lending, cash pooling, and FX exposure management.

Treasury teams settle more quickly because AP/AR billing routes are centrally managed, and payments between entities are streamlined and reduced. Intercompany charges in multinationals are settled days faster, improving liquidity and unlocking access to cash.

Intercompany operations are a growing source of risk, inefficiency, and cost in global finance. Fragmented ERP systems, manual processes, and limited visibility lead to significant challenges, including operational strain, employee burnout, and potential multi-million-dollar variances.

BlackLine Intercompany solutions, purpose-built for complex ERP landscapes, offer CFOs and finance leaders the ability to transform operations and unlock enterprise value through:

Business Scalability: Seamless integration across ERPs supports growth, M&A, and faster onboarding with minimal disruption.

Tax Optimization: Increased statutory deductibility, reduced VAT/indirect tax leakage, and better transfer pricing transparency.

Cash Flow and Working Capital Efficiency: Faster settlements, reduced FX exposure, and centralized cash visibility improve liquidity and planning.

Enterprise Risk Management: Stronger governance and audit readiness mitigate restatement risk and ensure regulatory compliance (e.g., BEPS, Pillar 2).

Reduced Cost of Finance: Automation and standardization lower operational costs, support faster close cycles, improve team morale, and increase overall finance efficiency.