Supercharge your efficiency, accuracy, and intelligence with our AI-powered invoice-to-cash solution.

Centralize data, make more informed decisions, and accelerate your cash flow. Explore the intuitive solution our customers call a “no-brainer.”

eInvoicing & Payments

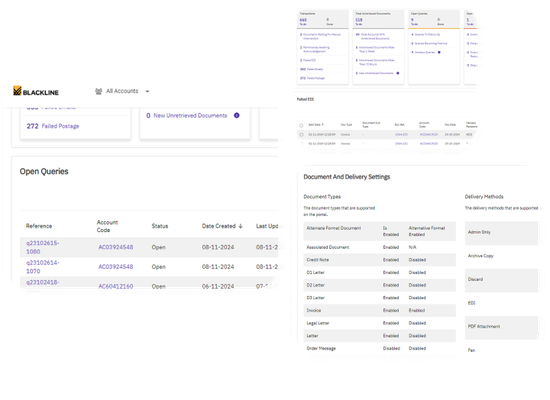

Access the detailed data you need to resolve inquiries quickly using our line-level customer query tool.

Deliver real-time feedback from tax authority systems to ensure compliance.

Distribute documents, access statements, and manage online payments with ease from our self-service portal.

Cash Application

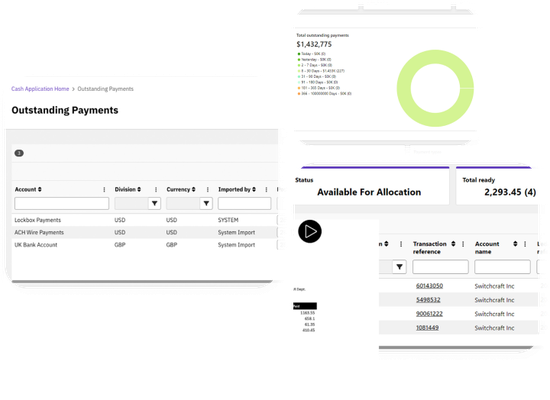

Get real-time insights on consolidated banking and ERP data across regions.

Eliminate your reliance on manual, spreadsheet-dependent processes for identifying inconsistencies between your accounts receivable subledger and banking details.

Hit the ground running with pre-built configurations based on BlackLine’s years of implementation experience and tailored to your specific operational needs.

Process customer data in multiple formats and use it for automatic payment applications to reduce unapplied cash by up to 99%.

Collections Management

Integrate your data on risk and payment performance to predict and adapt to changing customer behaviors.

Access intuitive dashboards that actually reduce complexity to increase visibility and sharpen collection strategies.

Perform detailed customer base analysis with ease using automated segmentation.

AR Intelligence

Capture data across multiple regions, countries, banks, ERPs, and CRMs. Consolidate relevant information into a centralized and unified platform.

Use AI-driven payment forecasting to collect data across the entire invoice-to-cash process, and continuously learn from customer payment behavior to improve accuracy over time.

Integrate your invoice-to-cash data with external data sources to develop contextual customer attractiveness scores.

Credit & Risk Management

Develop more informed risk strategies with access to collection and cash application data on tap.

Track changes in customer behavior in real time to analyze warning signs.

Advise on risk with ease using external credit agency integration.

Team & Task Management

Get real-time visibility into outstanding actions, aged debt profile disputes, and accounts on hold.

Dynamically adjust task distribution based on staff availability. Draft new work allocations without altering overall account ownership.

Use dynamic to-do lists that enable self-monitoring and performance evaluation.

Disputes & Deductions Management

Use an automated workflow to log, monitor, and analyze invoice disputes. Reduce aged debt by 30%.

Feed dispute data into your CRM and ERP. Maintain dispute workflows and give sales the data they need to make informed decisions.

Be audit-ready—always, with easy access to supporting documentation around raised disputes.

Unlock your strategic advantage with BlackLine Invoice-to-Cash.

From invoice to application, BlackLine’s unified platform gives you greater control and visibility. Automate tedious and error-ridden manual processes, capture insights in real time, and drive better decision-making.