Go the Record-to-Report Distance with Efficiency, Accuracy, and Intelligence

The period-end record-to-report process is a lot like a relay race. You want your finance and accounting team to start strong, run fast, and pass the baton to colleagues flawlessly until you cross the finish line.

Table of Contents

- Record-to-Report: Smooth Orchestration or Chaos on a Deadline?

- Multiple Challenges Complicate R2R

- From Record to Report in Record Time

- Best Practices to Optimize Your R2R

- Amplify Your Impact with BlackLine AI

- Recognition from Industry Experts

- Customers Applaud BlackLine’s Race-Ready Capabilities

- Explore real results and testimonials

Bad things happen when you fumble

the proverbial R2R baton:

Can You Run a Flawless R2R Race?

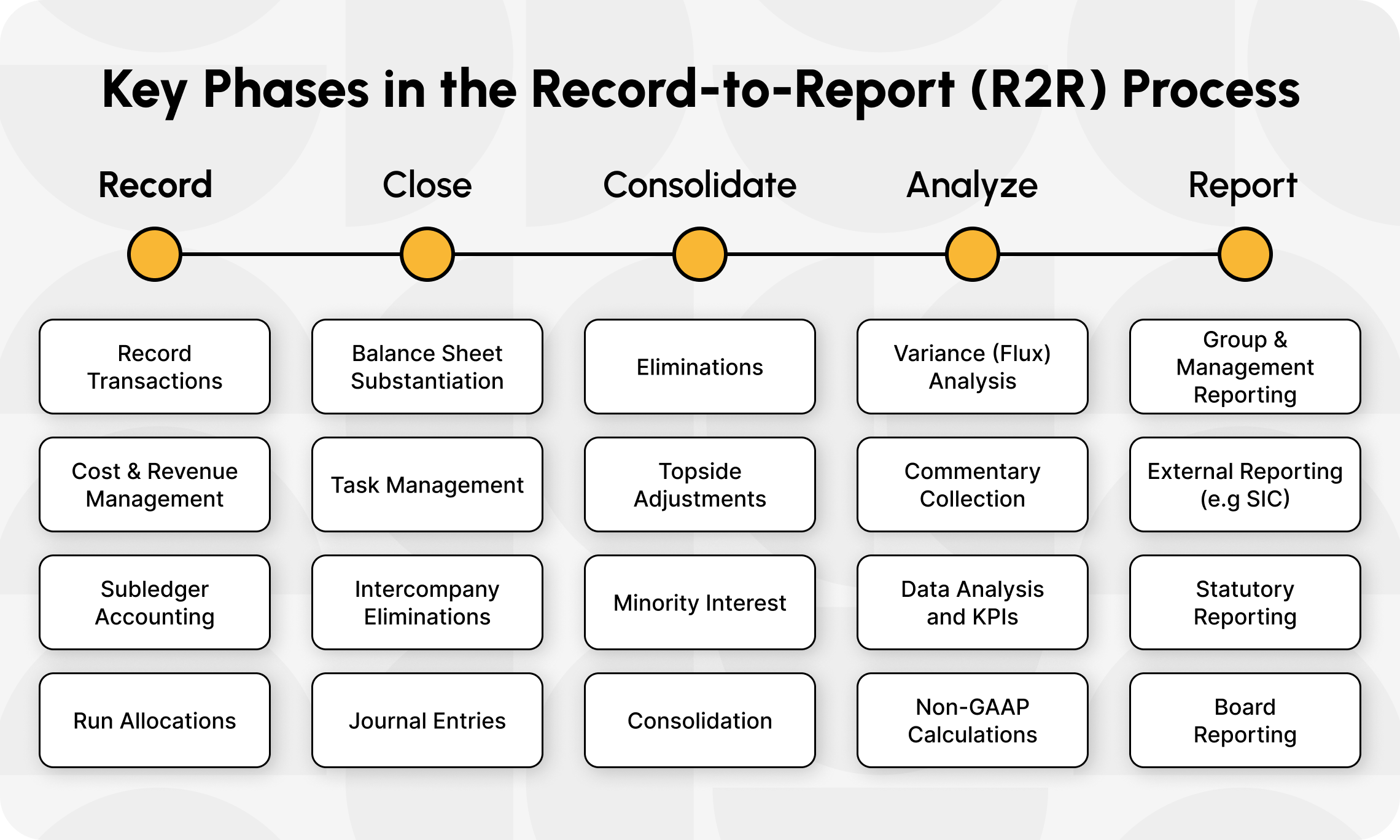

Traditional R2R can be a long and convoluted slog through five stages of record, close, consolidate, analyze, and report.

This outdated approach often results in inaccurate data, delayed reporting, and compliance risks, ultimately falling short of the CFO’s goal to deliver timely, reliable financial insights.

Gartner finds that 76% of CFOs say improving financial insights is a top priority.

From Record to Report in Record Time

Automation and optimization in key R2R areas can reduce manual work by an average of up to 80%.

Processes are standardized and automated. Milestones are clear. Stages proceed seamlessly across the organization. Exceptions are spotted and resolved proactively. You clear the finish line without dropping the baton—or being completely exhausted.

With BlackLine, CFO teams have the tools to go the distance in record time. No gaps, no half measures—just seamless, future-ready R2R that drives accuracy, efficiency, and intelligence at every step.

From:

- Manual reconciliation inefficiencies

- Delayed and inaccurate financial reporting

- Lack of real-time visibility into financial data

- Compliance risks and audit challenges

To:

- Automating and streamlining reconciliations, matching, and journal entries

- Unifying the close and accelerating reporting

- Gaining rapid insights for smarter decisions

- Strengthening controls and auditability

Best Practices to Optimize Your R2R

BlackLine’s AI-enabled platform automates, streamlines, and enhances control over critical R2R stages. Orchestrate processes quickly to deliver financial information that management needs.

With BlackLine’s actionable insights, you’re always ready to make your next move.

- Unify data

- Ensure compliance and control

- Automate key R2R tasks

- Leverage intelligent automation and AI

- Enable real-time collaboration

Amplify Your Impact with BlackLine AI

Run faster, smarter R2R cycles with BlackLine’s AI-driven features such as risk detection, predictive guidance, document and statement summarizers, variance automation, payment forecasting, and more.

Our AI technology is purpose-built to automate tedious tasks, generate game-changing insights, and liberate your F&A team for value-adding strategic initiatives.

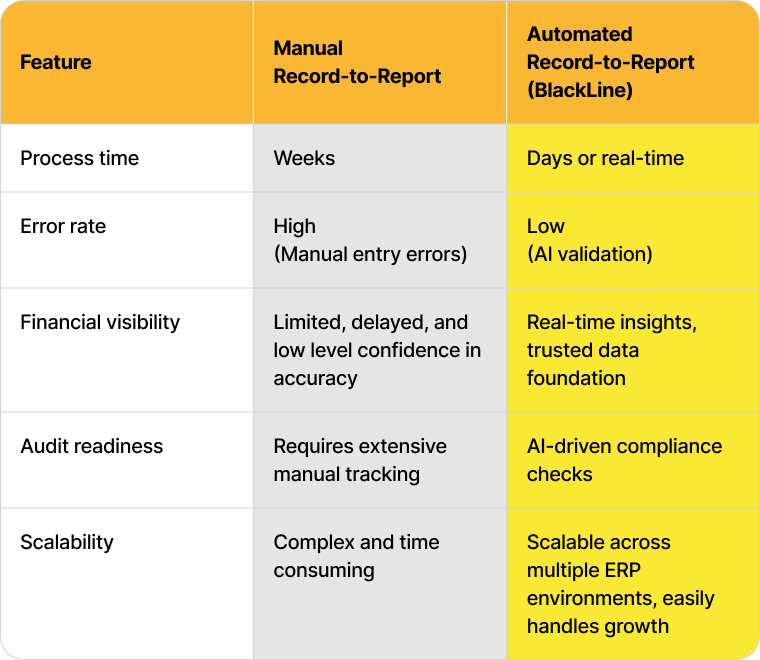

Manual vs. Automated:

A Stark Contrast

Recognition from Industry Experts

BlackLine is recognized by top industry experts and positioned as a Leader by top analyst firms.

“BlackLine’s approach to innovation in R2R reshapes how businesses handle F&A. BlackLine sets itself apart through its profound experience in R2R, fostering customer success through a guided approach.”

“With its cloud-native solution, BlackLine is uniquely able to meet the needs of organizations that seek to innovate and optimize their record-to-report processes.”

Customers Applaud BlackLine’s

Race-Ready Capabilities

More than 4,400 customers, including 68% of the Fortune 50, trust BlackLine to help them automate manual busywork and focus on strategic priorities.

Typical BlackLine customer results

“By automating redundant processes in BlackLine, we’ve improved the quality and accuracy of our financial information. People are now able to spend more time performing analysis.”

“Everyone on our team can now see the same information a lot quicker. Instead of waiting for one person to email out the Excel-based quarterly variance analysis, management can look in BlackLine to see real-time data.”