Intercompany accounting software for strategic value, clarity, and control.

Turn your intercompany accounting into a strategic advantage. Centralize data from multiple ERPs, view your intercompany activity in real time, and leverage the power of VerityTM AI for continuous resolution. Substantiate deductions, enforce transfer pricing policies, and prepare for e-invoicing mandates.

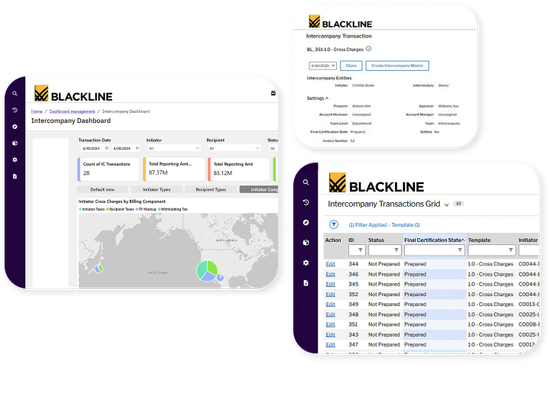

Intercompany Create

Eliminate spreadsheet-dependent, error-prone manual processes by automating intercompany allocations, cross charges, management fee invoicing, and the related journal entries.

Unify financial data across multiple ERPs into a single global intercompany subledger. Provide your teams with granular, real-time visibility across purchase orders, sales orders, and invoices.

Reduce risk and maximize your operational agility with touchless billing routes that standardize how transactions are billed across trading partners.

Provide critical support for global operations with Verity Summarize, which instantly generates concise summaries of complex Intercompany supporting documents, enabling faster research, review, and more confident decision-making.

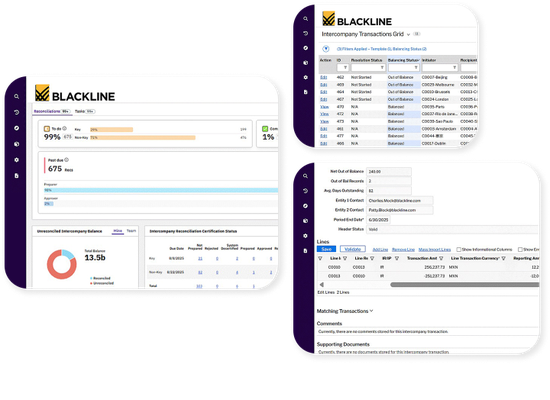

Intercompany Balance & Resolve

Never miss a beat with continuous exception identification that gives you a real-time view of all intercompany activity.

Expedite resolutions; reduce potential write-offs, fines, or penalties; and stay settlement-ready across the month with continuous exception clearing.

Ensure process consistency and enhance operational control with policy-based resolutions.

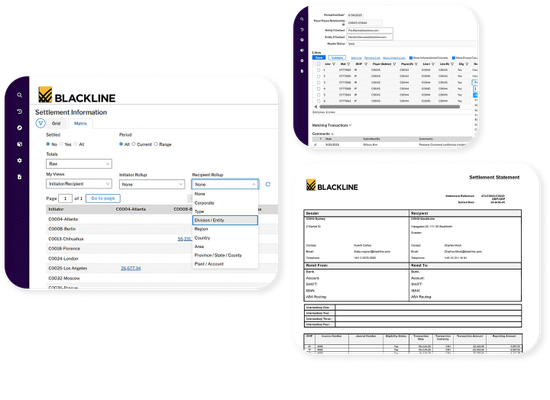

Intercompany Net & Settle

Create frictionless netting, settlement, and clearing processes by integrating your ERP and treasury management systems.

Reduce bank fees with fewer transactions for settlement. View netting-allowable and netting-restricted transactions with ease.

Optimize foreign exchange (FX) management and accelerate settlements with strategic cash pooling and forecasting.

Transform your intercompany operations from a cost center into a strategic advantage with BlackLine

Reduce the risk of fines or penalties and use the power of Verity AI to stay ahead of global compliance challenges—no matter how rapidly they change.