Dive deeper with Financial Reporting Analytics.

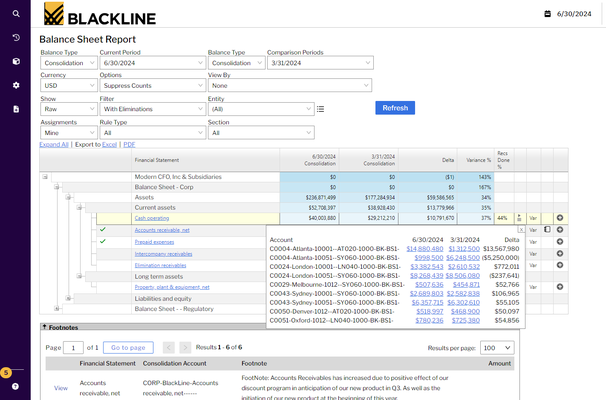

Get the data visibility you need to chart a more strategic course with Financial Reporting Analytics. Automate the review, rollup, and fluctuation analysis of financial statements—all at the group level. Access and analyze financials at any time from the cloud.

The value of Financial Reporting Analytics

of firms reported that manual processes remain the underlying reason for recurring adjustments made.

— Reported by Federal Reserve Regulatory Reporting Survey

of companies perform flux analysis as an essential part of audit control.

— Reported by BlackLine Customer Survey

Financial Reporting Analytics features

“In addition to the reporting time savings we’re seeing with BlackLine Financial Reporting Analytics, we're also improving accounting accuracy and quality. That frees up accountants and analysts to do more value-add work rather than just churning through manual data.”

Jeremiah Johnson,

Director, Global Close & Controls