BlackLine Blog

April 25, 2023

AR Success Metrics & Dynamics

Ernie Humphrey

Economic headwinds and continued geopolitical uncertainty inspired an inquiry into what performance metrics companies are using to measure accounts receivable (AR) success and the related dynamics. The Measuring & Managing AR Success: Benchmarks, Challenges, Opportunities survey was created to assess how companies are measuring AR success, the challenges faced in measuring, reporting and managing to AR performance metrics, and the impacts that AR and sales teams are having on AR performance metrics. This blog will focus on identifying the AR performance metrics most commonly being leveraged across the 342 companies surveyed and the related dynamics.

The most common AR performance metrics being leveraged by the companies surveyed are depicted in Figure 1. The results were interesting in that days sales outstanding (DSO) was only the third most identified AR metric of success behind bad debt write offs (32%) and past due AR at forty-nine percent (49%). Historically, research related to AR success metrics have commonly found that DSO is the most-used AR performance metric.

{ "type": "doc", "content": [] }

There has not been much research focused on factors that impact AR performance metrics and why. To manage AR effectively to positively impact these metrics, there should be an understanding of factors that can have negative as well as positive impacts on the metrics chosen to reflect AR performance. Factors that can impact AR performance which we examined in the survey include: the impact(s) of AR team members, the impact(s) of sales team members, the interactions between AR and sales teams, and a company’s credit policy.

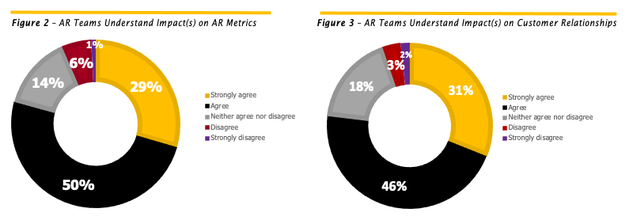

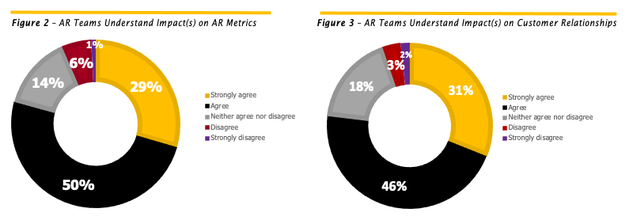

The actions of AR team members can have direct and indirect impacts on AR metrics. As such, we asked respondents if AR team members understand their impacts on customer relationships, which can translate into impacts on AR performance metrics. Over 20% of companies could not agree that their AR teams understand their impacts on customer relationships and/or their impacts on customer relationships (Figures 2 and 3). A lack of understanding in either area can pose a meaningful headwind to AR performance metrics, and as such, to AR success.

{ "type": "doc", "content": [] }

Negative impacts to customer relationships caused by AR team member actions can be attributed to communications in the forms of phone calls and/or emails to customers that have the wrong messaging, tone, and/or frequency. Monitoring and managing communications (including ensuring each interaction with a customer has a purpose) can help mitigate potential sources of AR performance headwinds that are being driven by AR team members. These measures are not being implemented by a meaningful number of the companies surveyed. Only 51% report that they manage and monitor AR team communications with customers, and 35% can’t agree that each communication with customers from an AR team member has a purpose (Figures 4 and 5).

{ "type": "doc", "content": [] }

Companies should ensure that each AR team member understands the direct and indirect impacts that their actions can have on customer relationships and AR performance metrics.

Sales teams can have negative impacts on AR performance metrics, including DSO. If sales team members make deals that include payment terms that fall outside of a company’s standard payment terms, then they are inherently creating an obstacle to managing to a DSO target. Over half of survey respondents reported that the sales team has a significant impact on DSO and over 40% have sales colleagues that seldom or never report sales made outside of standard payment terms to an AR team member. Companies should ensure that sales team members understand the cost of extending sales terms and report deals made that fall outside of standard payment terms to AR team members. Companies may even consider having an explicit approval by a sales leader for any deal made outside of standard payment terms and an automatic notification of any deal to the AR leader.

{ "type": "doc", "content": [] }

Sales teams can also impact AR success by closing deals that do not align with the company’s credit policy. Such deals can lead to past due AR and an increase to the amount of bad debt written off. Sales team members may have an incentive to close deals that do not align with the company’s credit policy if they are not aware of it and/or if it is not in alignment with sales goals. It makes no sense to expect a sales professional to adhere to a policy of which they are unaware that is not enforced before a sale is made. In addition, if there is no consequence to closing deals outside of the credit policy and it means getting a higher bonus, there exists a meaningful incentive to not always follow the policy. These potential headwinds to AR performance exist at 52% of companies relative to the misalignment of sales goals and credit policies and 39% relative to the credit policy not being effectively communicated to both AR and sales teams (Figures 8 and 9).

{ "type": "doc", "content": [] }

Survey respondents were asked to share which of a list of potential performance headwinds at the most significant negative impact on their company’s AR success metrics. The top two factors identified were a lack of visibility into customer interactions (33%) and a lack of strategic alignment between AR and Sales. (Figure 10).

{ "type": "doc", "content": [] }

Let’s take a deeper dive into the factors that have the most significant impacts on AR success metrics relative to company size in terms of the total number of company employees. Companies with 1-100 employees are designated as Small, 101- 1,000 employees as Mid-Market, and over 1,000 employees as Enterprise. Interesting results of this analysis include: a lack of visibility into AR processes was identified as the most significant by Enterprise companies (27%), and only identified as the most significant factor by 16% of Mid-Market and 10% of Small companies, and the lack of strategic alignment between AR and Sales was identified as the most significant by 38% of Small companies relative to 21% by Enterprise and 28% by Mid-Market companies.

{ "type": "doc", "content": [] }

To learn more, watch this on-demand webinar Defining & Communicating AR Success: Benchmarks, Challenges, Opportunities

Economic headwinds and continued geopolitical uncertainty inspired an inquiry into what performance metrics companies are using to measure accounts receivable (AR) success and the related dynamics. The Measuring & Managing AR Success: Benchmarks, Challenges, Opportunities survey was created to assess how companies are measuring AR success, the challenges faced in measuring, reporting and managing to AR performance metrics, and the impacts that AR and sales teams are having on AR performance metrics. This blog will focus on identifying the AR performance metrics most commonly being leveraged across the 342 companies surveyed and the related dynamics.

The most common AR performance metrics being leveraged by the companies surveyed are depicted in Figure 1. The results were interesting in that days sales outstanding (DSO) was only the third most identified AR metric of success behind bad debt write offs (32%) and past due AR at forty-nine percent (49%). Historically, research related to AR success metrics have commonly found that DSO is the most-used AR performance metric.

{ "type": "doc", "content": [] }

There has not been much research focused on factors that impact AR performance metrics and why. To manage AR effectively to positively impact these metrics, there should be an understanding of factors that can have negative as well as positive impacts on the metrics chosen to reflect AR performance. Factors that can impact AR performance which we examined in the survey include: the impact(s) of AR team members, the impact(s) of sales team members, the interactions between AR and sales teams, and a company’s credit policy.

The actions of AR team members can have direct and indirect impacts on AR metrics. As such, we asked respondents if AR team members understand their impacts on customer relationships, which can translate into impacts on AR performance metrics. Over 20% of companies could not agree that their AR teams understand their impacts on customer relationships and/or their impacts on customer relationships (Figures 2 and 3). A lack of understanding in either area can pose a meaningful headwind to AR performance metrics, and as such, to AR success.

{ "type": "doc", "content": [] }

Negative impacts to customer relationships caused by AR team member actions can be attributed to communications in the forms of phone calls and/or emails to customers that have the wrong messaging, tone, and/or frequency. Monitoring and managing communications (including ensuring each interaction with a customer has a purpose) can help mitigate potential sources of AR performance headwinds that are being driven by AR team members. These measures are not being implemented by a meaningful number of the companies surveyed. Only 51% report that they manage and monitor AR team communications with customers, and 35% can’t agree that each communication with customers from an AR team member has a purpose (Figures 4 and 5).

{ "type": "doc", "content": [] }

Companies should ensure that each AR team member understands the direct and indirect impacts that their actions can have on customer relationships and AR performance metrics.

Sales teams can have negative impacts on AR performance metrics, including DSO. If sales team members make deals that include payment terms that fall outside of a company’s standard payment terms, then they are inherently creating an obstacle to managing to a DSO target. Over half of survey respondents reported that the sales team has a significant impact on DSO and over 40% have sales colleagues that seldom or never report sales made outside of standard payment terms to an AR team member. Companies should ensure that sales team members understand the cost of extending sales terms and report deals made that fall outside of standard payment terms to AR team members. Companies may even consider having an explicit approval by a sales leader for any deal made outside of standard payment terms and an automatic notification of any deal to the AR leader.

{ "type": "doc", "content": [] }

Sales teams can also impact AR success by closing deals that do not align with the company’s credit policy. Such deals can lead to past due AR and an increase to the amount of bad debt written off. Sales team members may have an incentive to close deals that do not align with the company’s credit policy if they are not aware of it and/or if it is not in alignment with sales goals. It makes no sense to expect a sales professional to adhere to a policy of which they are unaware that is not enforced before a sale is made. In addition, if there is no consequence to closing deals outside of the credit policy and it means getting a higher bonus, there exists a meaningful incentive to not always follow the policy. These potential headwinds to AR performance exist at 52% of companies relative to the misalignment of sales goals and credit policies and 39% relative to the credit policy not being effectively communicated to both AR and sales teams (Figures 8 and 9).

{ "type": "doc", "content": [] }

Survey respondents were asked to share which of a list of potential performance headwinds at the most significant negative impact on their company’s AR success metrics. The top two factors identified were a lack of visibility into customer interactions (33%) and a lack of strategic alignment between AR and Sales. (Figure 10).

{ "type": "doc", "content": [] }

Let’s take a deeper dive into the factors that have the most significant impacts on AR success metrics relative to company size in terms of the total number of company employees. Companies with 1-100 employees are designated as Small, 101- 1,000 employees as Mid-Market, and over 1,000 employees as Enterprise. Interesting results of this analysis include: a lack of visibility into AR processes was identified as the most significant by Enterprise companies (27%), and only identified as the most significant factor by 16% of Mid-Market and 10% of Small companies, and the lack of strategic alignment between AR and Sales was identified as the most significant by 38% of Small companies relative to 21% by Enterprise and 28% by Mid-Market companies.

{ "type": "doc", "content": [] }

To learn more, watch this on-demand webinar Defining & Communicating AR Success: Benchmarks, Challenges, Opportunities

About the Author