Unleash productivity with an end-to-end financial close and consolidation solution.

Unify your data, accelerate your close and consolidation, and empower your team to drive strategic impact with trusted, auditable, real-time intelligence delivered by VerityTM AI.

Account Reconciliations

Automate the load of reconciliation supporting items with standardization and consistency.

Increase efficiency with auto-reconciliation rules and standardized reconciliation templates.

Use dashboards to view reconciliation status, timeliness, and quality—in real time.

Prevent errors by eliminating version control challenges.

Transaction Matching

Ingest and transform high volumes of transaction-level data from third-party systems such as ERPs, banks, payroll providers, revenue, lease accounting, and procurement.

Apply flexible, easy-to-use rule-based automation to enhance control and reduce the risk of process breakdowns and undetected financial statement errors.

Automatically compare and match transactions so employees can investigate differences and spend time on more strategic activities.

Send reconciling items to your account reconciliations and automatically create adjusting journal entries based on transaction-matching results.

Journal Entry

Unify data from ERPs, third-party sources, and other BlackLine solutions to automatically create journal entries and post them directly to your ERP, eliminating spreadsheet-dependent manual journal entry processes.

Generate journals from supporting items on your reconciliations as part of your transaction matching analysis, as topside entries for consolidation, or directly from raw data feeds.

Mitigate risk proactively and ensure regulatory compliance with account validations, threshold-based approvals, and end-to-end audit trails documenting data imports, journal postings, and user access.

Smart Close for SAP

Limit manual touchpoints and enable exception-based close management.

Coordinate processes from corporate headquarters to local entities to ensure global consistency with local flexibility.

Use our centralized platform to facilitate a seamless and continuous close process with a great user experience, directly in SAP.

Account Analysis

Continuously monitor transaction-level details to identify potential risks and exceptions automatically.

Free up resources by eliminating manual examination of large transactional volumes, allowing your team to focus on higher-value tasks.

Improve decision-making with real-time insights and integration with BlackLine Account Reconciliations for a streamlined, proactive approach to financial analysis.

Consolidation

Eliminate spreadsheet-dependent, complex consolidation activities with a fully user-configurable automation solution for balance aggregation, ownership interest calculations, intercompany eliminations, and more.

Gain a centralized and real-time view of consolidation, from aggregation to top-side adjustments and supporting documentation.

Reduce manual errors and ensure audit-ready financials with built-in controls, validations, and a fully integrated audit trail.

Reporting & Analysis

Automatically generate real-time entity and group-level financial statements.

Vertically integrate analysis with the ability to drill down from financial statements to transactional details and commentary prepared earlier in the close.

Generate detailed insights with Verity AI, BlackLine’s trusted intelligence layer, using features like Verity Summarize and Verity Draft to accelerate financial variance analysis and enable earlier stakeholder communication.

Ensure compliance with automated workflows, real-time tracking, and role-based sign-offs.

Task Management

Track and manage thousands of tasks from a configurable cloud-based command center that seamlessly connects your financial close processes.

Streamline processes and reduce risk with automated task lists, assignments, and workflows.

Improve visibility with real-time dashboards that monitor tasks throughout the financial close process, helping you remove bottlenecks and catch overdue tasks.

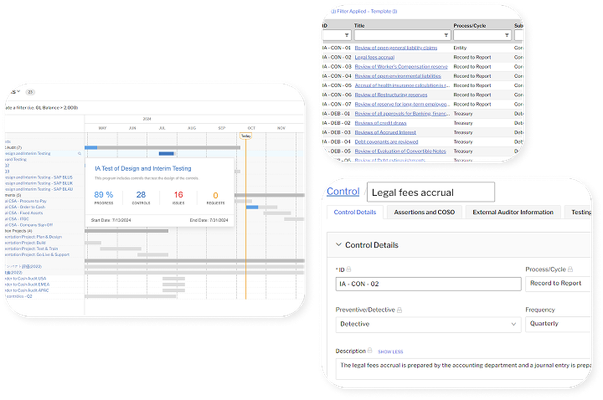

Compliance

Centralize risk management and compliance tasks for efficient tracking, control testing, and real-time reporting.

Foster seamless collaboration with a single platform for projects, tasks, and supporting documentation to ensure timely testing and issue resolution.

Maintain global visibility across audits, controls, and risks while ensuring accountability with role-based permissions and segregation of duties.

Evolve beyond tedious, spreadsheet-heavy processes.

Take control of your entire close and consolidation workflow, deploy intelligent automation with Verity AI, and execute a process you can trust.