Achieving Significant Productivity Gains with Savings Valued at Over $1.2M Every Year

Red Wing Shoe Company (Red Wing) is a premium quality work and safety footwear brand. Founded in 1905, the American company manufactures and retails its shoes, and operates its tannery along with two domestic manufacturing facilities. Red Wing currently distributes its products to over 100 countries and over 4,000 US retail locations, including company-owned, dealer-owned, and branded stores.

Le défi

Red Wing was previously using Excel spreadsheets and email to manage their day-to-day accounting activities. The legacy accounting system lacked standardization and controls; thus, as the company grew, managing the financial processes became increasingly inefficient and laborious. Spreadsheets were housed across four geographic locations, key controls were manual and time-consuming, and without a centralized repository of accounting data, the Controllership lacked visibility into the completeness of its financials.

Manually preparing a high volume of monthly reconciliations, the finance team was understaffed and unable to resolve reconciling items timely. The backlog of unreconciled cash transactions posed a significant auditing risk. Each journal entry also had to be approved via email and then saved in a shared drive. The process proved time-consuming, and management had difficulty implementing traceability or accountability measures. These issues would often lead to missing deposits from the ledger and out-of-date financials, increasing the risk of undetected fraud.

Pourquoi BlackLine

Recognizing the need to modernize its accounting process, Red Wing began searching for a dedicated financial close and consolidation (FCC) software solution in 2017. The company considered the software services of Trintech and BlackLine, before selecting BlackLine for the following reason:

Consolidation. Red Wing’s priority was to achieve organizational visibility by consolidating all its financial processes and data in a single location, as well as implement standardization and controls over its workflows. Red Wing selected BlackLine because it provided a comprehensive solution platform with multiple applications to address various elements of their accounting processes, from reconciliations and transaction matching to journal entry and reporting.

Usability. Another consideration was reducing labor and time input as the accounting teams needed to manage an increasing workload without driving up headcount. BlackLine’s seamless user interface design and intuitive guided workflow enabled Red Wing to quickly onboard both new and existing employees. In addition to the solution’s range of functionality and ease of use, BlackLine’s customer support and wholistic training services were also deciding factors.

Les résultats

Increased productivity from reduced workloads. BlackLine’s Account Reconciliations enables accountants to reduce the number of reconciliations by creating account and cost center combination groupings. Red Wing reduced the volume of monthly account reconciliations by over 7,000. The decreased workload saves accountants at the corporate office over 3,500 work hours every month and shortened their retail store cash reconciliation process from an average of 40 days to about four days. Red Wing leveraged Transaction Matching to automate journal matching and cash reconciliations to reduce the number of manual actions for its retail finance team.

Time savings from streamlined tasks. With Blackline’s platform, Red Wing has built standardized workflows to facilitate and automate its financial processes. For example, BlackLine’s Journal Entry has accelerated the journal entry process from creation to approval with customizable workflows and controls, reducing the cycle time of each entry by over 33 percent. Altogether, the guided workflows save staff, managers, and directors a total of 1,500 hours every year for other value-add tasks.

Improved organizational visibility. By consolidating its financial information under BlackLine’s platform, Red Wing’s employees now have access to a central repository for all financial close activities. The connectivity between applications on BlackLine’s platform and integration with Red Wing’s multiple ERP solutions provided a single source of truth for financial data across the entire organization. Management has gained confidence in the accuracy of reported numbers and can better understand changes through traceability functions. Staff is also more productive as they avoid mistakes by always sourcing correct and up-to-date data, which alleviates the auditing risks they previously faced.

4:21

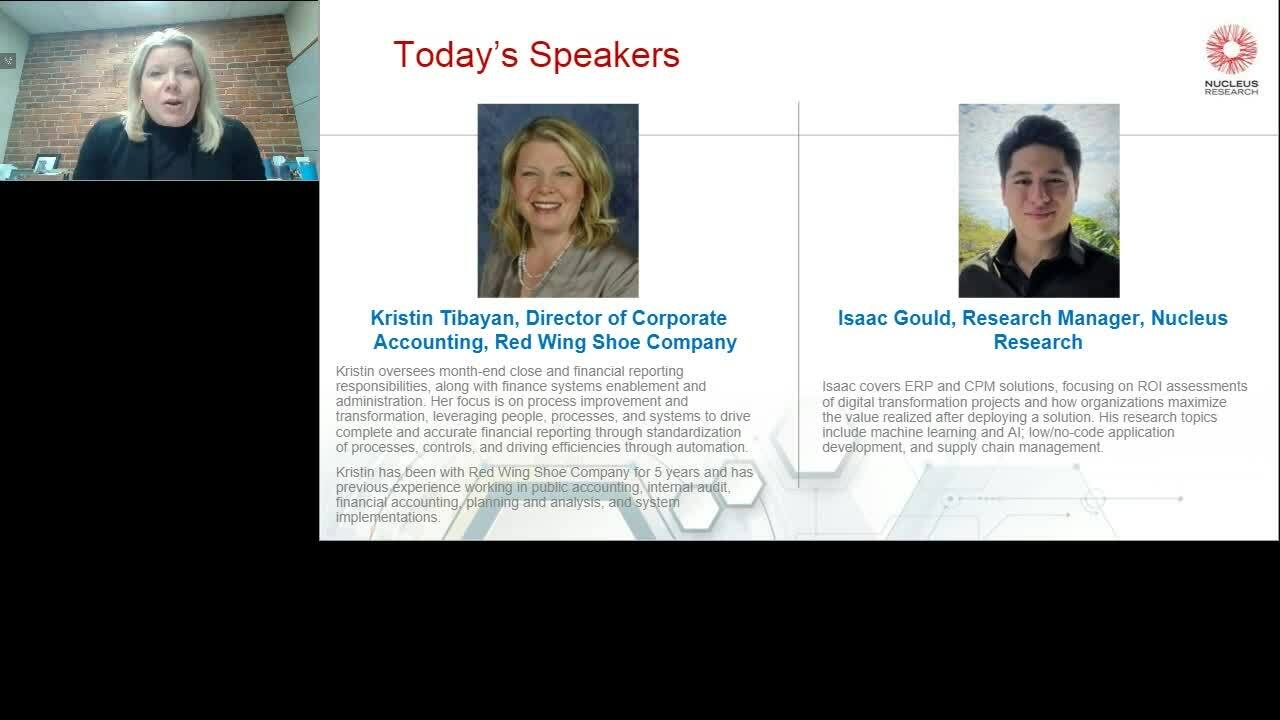

Red Wing Shoes and Nucleus Research Discuss BlackLine Journey

Retail

Infor

United States

Enterprise

Realized 379% ROI and a payback period of 4.8 months

Reduced the volume of monthly account reconciliations by over 7,000

Shortened its retail store cash reconciliation process from an average of 40 days to about 4 days

Accelerated journal entry process, reducing the cycle time of each entry by over 33%

Implemented guided workflows that save staff a total of 1,500 hours every year for other value-add tasks

Don't take our word for it.

Request a customer reference.

In many cases we can connect you with a current customer for first-hand feedback on their experience with BlackLine.

Request a Reference